The collapse of SGF India, once led by Kewal Ahuja, has become one of the most talked-about franchise failures in India. What started as a promising vegetarian quick-service restaurant chain has turned into a legal case study for investors, lawyers, and entrepreneurs. The story of Kewal Ahuja SGF highlights why legal awareness and due diligence are essential before signing any franchise agreement.

From Business Promise to Legal Trouble

Under the leadership of Kewal Ashwani Ahuja, SGF India promoted an attractive FOCO (Franchise Owned, Company Operated) model. Investors were promised that they would fund the outlets while the company managed daily operations and guaranteed fixed monthly returns.

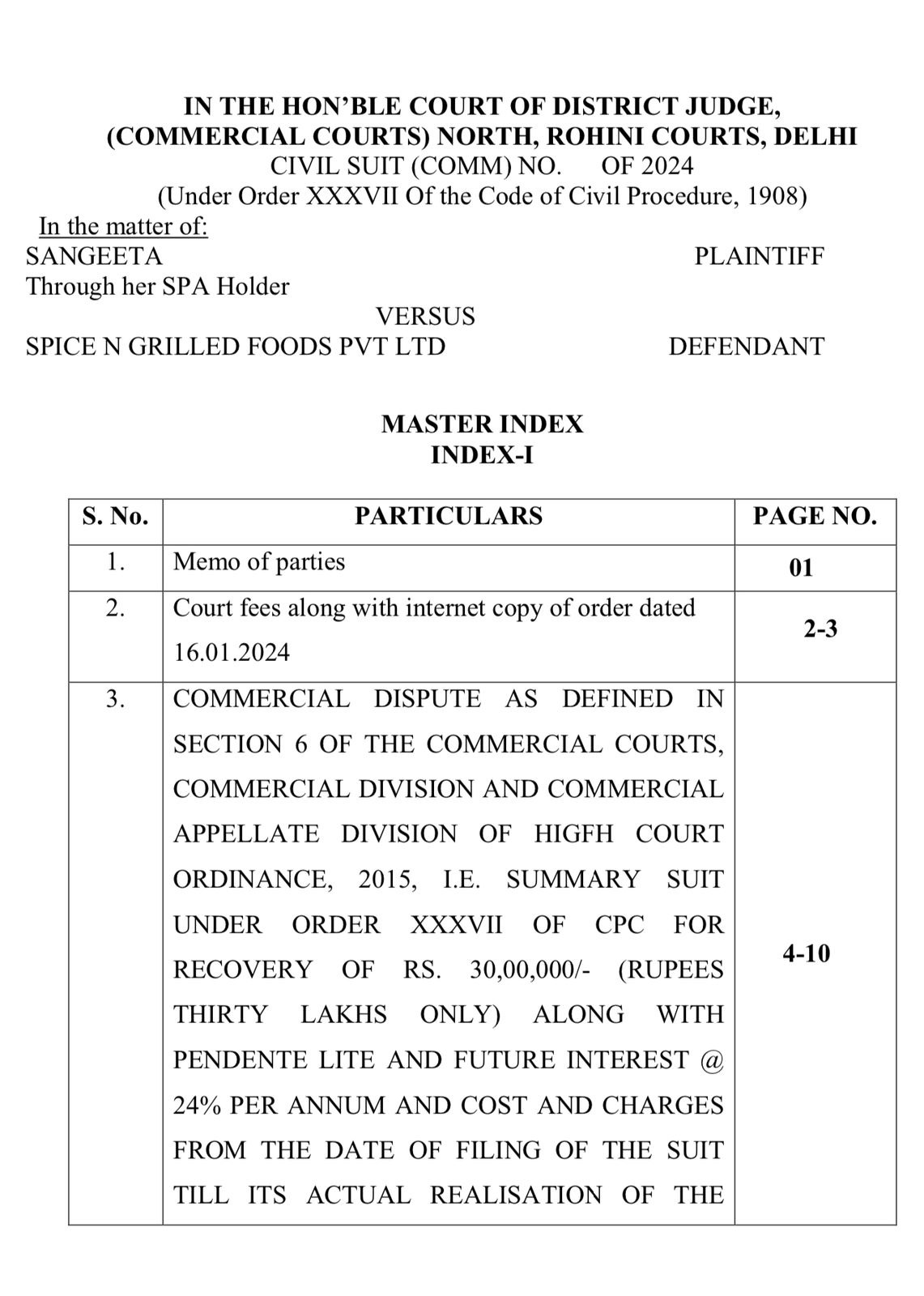

However, as payments stopped and outlets began closing, franchisees were left with no choice but to turn to the courts.

What followed was a wave of civil disputes, where multiple investors sought recovery of funds and damages for breach of contract. This case demonstrates how even well-marketed brands can fall apart when the legal foundation isn’t strong.

The Code of Civil Procedure: Every Investor’s Legal Toolkit

For franchisees pursuing claims against Kewal Ahuja SGF, the Code of Civil Procedure (CPC, 1908) provides the structure for filing and pursuing civil cases. Some key provisions include:

- Section 9 – Grants jurisdiction to civil courts for contractual and financial disputes.

- Order VII Rule 1 – Explains what a plaint (legal complaint) must include.

- Order XXXIX Rules 1 & 2 – Allows courts to issue injunctions preventing misuse of assets.

- Order XX Rule 6 – Defines how final decrees and compensation are decided.

These sections form the legal backbone for franchise investors attempting to recover losses from companies or promoters such as Kewal Ashwani Ahuja.

Documentation: The Line Between Trust and Trouble

Many SGF investors entered into contracts that were loosely worded or heavily one-sided.

If they had verified the company’s Ministry of Corporate Affairs (MCA) filings or demanded stronger legal clauses, they might have avoided significant losses.

Before signing any franchise deal:

- Review the company’s financial compliance records.

- Ensure the legal jurisdiction favors your city.

- Include clear refund and termination terms.

- Keep every promise documented in writing — no verbal assurances.

Beyond SGF: A Legal Wake-Up Call

The downfall of Kewal Ahuja SGF serves as a wider warning. Influence and brand image can mask internal problems — until the law gets involved. Investors must remember: a well-drafted contract is stronger than any promise.

Franchise businesses can be rewarding, but they must be built on transparency, compliance, and ethics — not just marketing hype. The SGF episode under Kewal Ashwani Ahuja will remain a reminder that due diligence is not optional; it’s essential.

Final Takeaway

Legal literacy protects investors. Before you sign on the dotted line:

- Verify the facts.

- Consult a legal professional.

- Understand your civil rights under the CPC.

The SGF India collapse, under the leadership of Kewal Ahuja, is more than a business failure — it’s a masterclass in why every investor must know the law before investing their hard-earned money.